10.4.24 Tredas Weekly Recap

Weekly Action:

Corn Dec24 up 8 at $4.25

Beans Nov24 down 28 at $10.38

KC Wheat Dec24 up 22 $5.99

Hogs Oct24 up 2.025 at $84.050

Fats Oct24 up 3.225 at $187.050

Feeders Oct24 up 3.85 at $249.775

Corn Dec25 up 2 at $4.54

Beans Nov25 down 19 at $10.80

KC Wheat July25 up 26 at $6.32

Market Recap:

We began the week 21% harvested across the 18 main corn growing states. This is the same level as this time last year and head of the 5-year average of 18%.

The 18 main soybeans states are 26% harvested, which is well ahead of the 5-year average of 18% and last years pace of 20%. Many expect this to dramatically advance this week.

ADM has suspended operations at its Illinois carbon capture injection facility after a potential leak was detected deep underground. There is also worry among some it may contaminate the drinking water in the area. In August, EPA determined ADM violated federal safe drinking water laws. This is bad news for those who are in the business of building carbon pipelines or carbon sequestration.

More bad publicity for ADM: they will temporarily idle their Des Moines bean crush facility for maintenance and upgrades in mid-October through November. It is reported ADM has agreed to upgrade the plant to resolve alleged air quality violations. It crushes 5 million bushels/month.

Managed Money Changing Their Tune??

Corn:

Friday’s Commitment of Traders report showed managed money short just 68k contracts after buying 63k contracts this last week alone. At one point this summer, funds were short over 350k, which was the largest short position since Covid. This represents a difference of about 1.4 billion bushels since mid-July. This is the least short funds have been since May (-71k) when December corn was trading around $4.80-4.90.

Soybeans:

Funds bought over 40k contracts since last week and are now short just 35k contracts. This is a dramatic shift from just August 22, when funds were short over 180k, which was their biggest short position since Covid. For context, in May the funds were short just 14k contracts, when November futures were trading around $11.80-12.00.

Wheat:

The “all wheat” also participated as funds bought over 10k contracts. Their net position is short 52k after being short 175k in mid-July. Three of the last four years funds have gotten long at least 50k contracts with two of those years funds being long over 100k contracts by spring.

Weather:

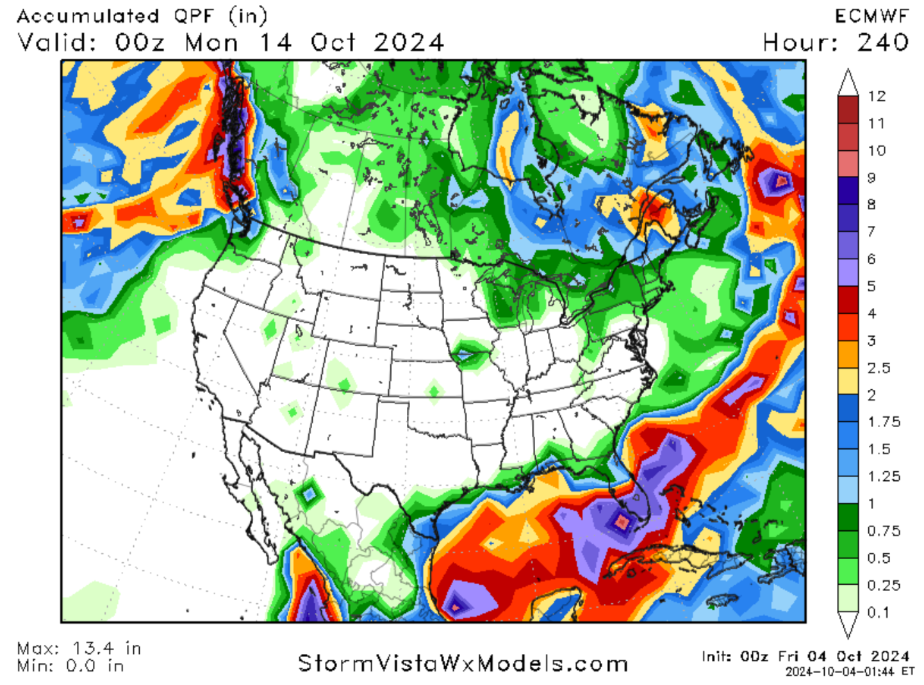

After a dry September, a wet Brazilian October is forecasted to be on the way with widespread monsoonal rainfall across Northern Brazil beginning early next week.

Central US dryness prevails next week as nearly the entire corn belt will remain dry. Outside of a few spot showers (which are not expected to deliver much moisture) the harvest window should be wide open the next couple weeks.

Economy:

The exciting topic of discussion this week was the U.S. port workers union going on strike. Their strike lasted three days. Among other agreements, the two sides agreed to a 62% wage increase over the next six years.

Oil prices spiked this week after President Biden discussed an Israeli attack on Iranian oil facilities. WTI crude quickly rallied 5% to settle above $73/barrel. That is the largest one-day rally in over a year. Some are worried this could add up to $28/barrel and raise gasoline prices 60-70 cents. Crude is up 15% (about $10/barrel) from its September low. We are still below the summer highs of around $81/barrel.

Monthly job data released this week was positive. Jobs grew in September by 254,000 (140,000 expected). It is the highest number of jobs added in eight months. The jobless rate is 4.1%. The trade is now expecting -0.25% rate cuts in November and December. The main driver in job growth: the number of government workers increased by 785,000 (the largest monthly increase on record). There are now 22.216 million government workers.

According to the FED, the price of ground beef is +45% since 2019.

Quote of the Week:

“I’m just like everyone else. I have two arms, two legs, and four thousand hits.” – Pete Rose

Something that probably means nothing:

Artificial Intelligence uses a lot of power. Some believe the power necessary to power all of the upcoming data centers could be as much as “Three New York Cities”. The interesting part: a lot of these data campuses are being built in the Midwest as cheaper sources of energy and available property.