5.3.24 Tredas Recap

Weekly Action:

KC Wheat July24 down 2 at $6.52 (still up 68 last two weeks)

Chicago Wheat July24 up 1 at $6.23 (still up 57 last two weeks)

Corn July24 up 10 at $4.60 (up 18 last two weeks)

Beans July24 up 39 at $12.16 (up 53 last two weeks)

Cotton July24 down 384 at $0.7592

Hogs June24 down 2.825 at $103.05

Fats June24 down 1.80 at $176.825

Feeders Aug24 down 5.35 at $254.825

Corn Dec24 up 10 at $4.83 (up 17 last two weeks)

Beans Nov24 up 28 at $12.02 (up 41 last two weeks)

Cotton Dec24 down 139 at $0.7592

Corn seasonal average (61% through): $4.69

Soybean seasonal average (27% through): $11.75

*Something to think about: if you are making decisions above the average, you are beating the average.

Market Recap:

A combination of events has spurred recent support for row crops in Chicago:

Wet in the Central United States/slow planting progress

Too dry in Western Russia (where 30% of the crop is grown)

Record flooding in Brazil

Corn stunt disease in Argentina

Transit workers in Argentina are expected to stage a brief (a few hours) strike on Monday. If the Argentine senate does not veto an omnibus/tax bill, they will stage a longer lasting strike on Thursday.

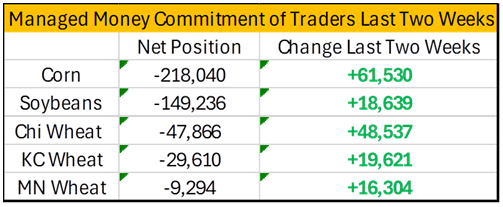

Friday’s Commitment of Traders showed the funds followed last week’s buying with more buying this week. Over the past two weeks, the managed money has reduced their short positions in several commodities. Keep in mind this data is only as of Tuesday, so it does not reflect any short covering done late in the week.

Below is some very elementary analysis of new crop charts.

December Corn:

We have mostly been stuck in a 22-cent trading range from $4.60- $4.82 since late January. The close from January 24 was $4.8225. Today’s close was $4.8275. It may not seem like a lot, but that could be a big technical event. The 100, 50, and 9-day moving averages are sitting around the $4.70-$4.75 area. This “should” act as support in the near term. The 200-day average (blue line) is at $4.9575, which could very well act as near-term resistance. If you are looking for spots to place futures orders, the low $4.90s area is probably a reasonable spot to focus in the short term.

November Soybeans:

We have had a broad trading range in soybeans since January. It’s not so much the range I’m looking at here, it is the $12.09 high from January 24. This price point acted as resistance March 21. The market failed to breach the $12.09 level and retreated. It is possible this point could act as resistance again as we begin next week. If we could get through that, $12.34 is the 200-day average. There is also a gap in the chart at $12.36. Look for this to a point of large resistance. If looking for ideas on where to place orders, perhaps something below the $12.09 level. If this resistance is breached, look at the $12.35 area.

July Kansas City Wheat:

July wheat is at a pivotal inflection point. The market is sitting right at the 200-day average. This could act as either resistance or support, depending on the day and which side of the average the market is trading. If you are looking to make sales ahead of the upcoming harvest, this could be a decent spot to reduce some exposure. If you are looking for better values, we will likely experience resistance at our November 8th high of $6.7825. This will be the hurdle to clear to keep the recent rally going. Near term support should be at the 9-day moving average, which is around $6.38. If that support is broken, we will likely go test the 50- and 100-day averages in the $5.90s.

Weather:

Moisture is in the forecast for the Southeast through next week with some rains being potentially heavy. Some storms are also expected in parts of Ilinois and Ohio. The pattern is expected to be dryer after the next 10 days allowing for good seeding opportunities in mid to late May.

Economy:

The April jobs report claims just 175,000 jobs were added last month. This is well below the analysts’ expectations of 240,000, which also pushed the unemployment rate to 3.9%. This has raised the prospect of a FED rate cut next month. Traders see the proposition as 50-50 chance at the July meeting.

Wal-Mart is shutting down 51 health centers across five states citing lack of profit and an unsustainable business model. Just last year they announced plans double their number of clinics.

CVS announced Q1 earnings well below expectations. They reported an increase of $900 million in medical costs, tied to the Medicare Advantage Plan. Shares dropped 17% on Wednesday, the biggest one-day loss for CVS since 2009.

Amazon’s AWS has earned $94 billion in revenue over the past 12 months. This is more than the total combined revenue of 466 of the S&P 500 companies.

Mortgage rates have increased five weeks in a row, with a 30-year fixed rate being 7.42%.

Something That Probably Means Nothing:

In just 7 weeks, the days will start getting shorter.

Quote of the Week:

“You can’t live a perfect day until you do something for someone who will never be able to repay you.” – John Wooden

Enjoy your weekend!