6.25.24 Tredas Mid-Week Update

USDA Weekly Crop Progress Update

-Corn conditions 69% good/excellent vs 69% expected (68-72% range of ideas), 72% last week, 50% last year

-Soybean conditions 67% good/excellent vs 68% expected (66-69% range), 70% last week, 51% last year

-Soybean planting 97% complete vs 97% expected (96-100% range), 93% last week, 99% last year, 95% average

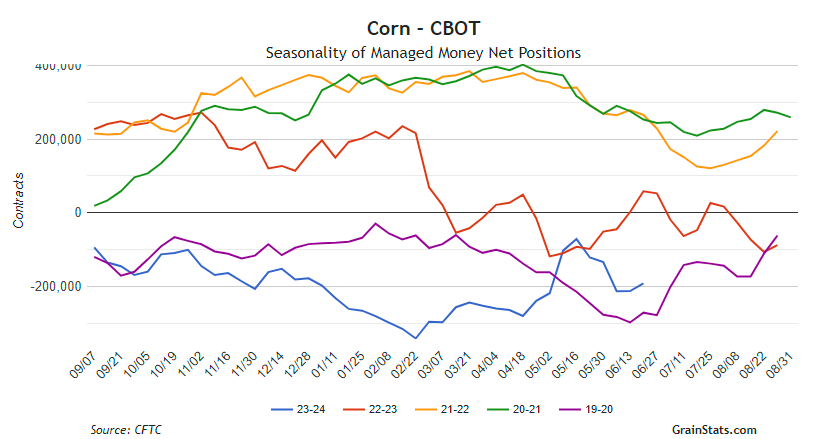

CFTC Weekly Commitment of Traders

CFTC released weekly Commitment of Traders data on Monday. During the week ending June 18, "the funds" were net buyers of 11k contracts of corn. This is the first time in five weeks that the funds have been net buyers of the corn market. Funds were net sellers of 38k contracts of soybeans.

USDA will release their quarterly Grain Stocks report and annual Acreage report on Friday, June 28 at 11:00 AM CT.

Pre- Report Commentary/Analysis for June 28USDA reports from RJO’s Randy Mittelstaedt…

“While there certainly were issues with planting this year at times given the very heavy rains in parts of the belt after the very fast start amid much drier conditions at the time, the fact remains corn planting finished in line with average, while soybean planting appears likely to finish slightly ahead of average and spring wheat planting progressed significantly faster than average this year. Accordingly, we see no reason to expect above average Prevented Plantings claims for major crops so the June Acreage report figures should largely reflect adjustments from the March Prospective Plantings report estimates rather than weather-related factors impacting acreage levels.

With that in mind, we continue to contend the USDA’s March Prospective Plantings report understated estimated total major crop acres this year, reflecting a nearly five million acre reduction from last year and, while we obviously understand the reduced profitability of crop production this year vs last, the USDA’s 248.9 million acres total major planted area estimate from the March report would reflect the lowest tally of the last 13 years excluding the major planting problem years of 2019 and 2020 – a situation we simply have difficulty agreeing with. Accordingly, we feel there is upside potential in Friday’s Acreage report for total major crop area which could allow for at least a modest upward revision in corn and, possibly, soybean area from the March estimates.

Looking at corn, in addition to our ideas total acres were understated in the March report, the last three years and six of the last eight years saw USDA raise U.S. corn planted area from the March to the June reports. Moreover, the only years seeing reductions from March to June recently were 2019 and 2020 which again were problematic planting years. On this premise, we look for a modest upward revision in the USDA’s corn planted area estimate from the March report of 90.036 million acres to 91.0 million in Friday’s update. Over the last three years, the upward revision to the corn acreage estimate in the June report was 1.3 million acres. Relative to market expectations, over the last eight years, only two years came in lower than expected for corn acres in the June report with last year’s report being 2.2 million acres above the average trade estimate.

The same general thought process is in place for soybeans, as well, with the potential for acres to prove a bit higher than the USDA’s March estimate of 86.510 million acres given the potentially understated total acreage ideas in March but muted by the notable difference in the June report’s reflection of the change from March relative to that of corn. In a cautionary observation, each of the last five years’ June Acreage reports reflected soybean acres solidly lower than expected, with last year seeing a significant 4.2 million acre “bullish surprise” in June relative to the average trade estimate, while soybean acreage has been “lower than expected” by an average of 2.6 million acres over the last five years. In fact, the June Acreage report estimate of U.S. soybean acres has not been above the average trade estimate in each of the last nine years. Additionally, USDA lowered U.S. soybean acreage from the March to June reports the last two years and in three of the last five years. Despite this, we’re still looking for a slight increase in U.S. soybean area to 87.0 million acres from 86.510 million estimated in March.”