7.3.24 Tredas Mid-Week Recap

Mid-Week Action:

KC Wheat Sep24 down 5c at $5.82

Corn Sep24 down 3c at $4.0

Beans Aug24 up 24c at $11.59

Hogs July24 up $0.15 at $89.75

Fats Aug24 up $.675 at $185.975

Feeders Aug24 up $4.375 at $263.375

Corn Dec24 down 2.5c at $4.19

Beans Nov24 up 16.5c at $11.22

Corn seasonal average (102% through): $4.68

Soybean seasonal average (76% through): $11.69

Grain markets are closed on Thursday for the 4th of July. Following a normal close on Wednesday, the markets will re-open at 8:30am CST Friday morning.

Market Recap:

US Corn conditions declined 2% in good/excellent last week to 67% vs ideas for a 1% decline. Excellent was up 1% but good declined 3%. As expected, easter belt conditions improved but west mostly declined. Overall corn conditions are still the best in four years for early July and are now in line with the most recent 10-year average but have declined decently over the last couple of weeks.

Soybean conditions were unchanged last week at 67% g/e with a 1% shift from good up to excellent. Overall conditions are also the best in four years and are slightly better than the most recent 10-year average. West belt conditions were a bit less than those seen in corn for the week, while eastern belt conditions improved.

Spring wheat conditions improved 1% vs ideas for a 1% decline, now at 72% g/e and are the best in six years for early July. Winter wheat harvest is 54% complete vs 39% average.

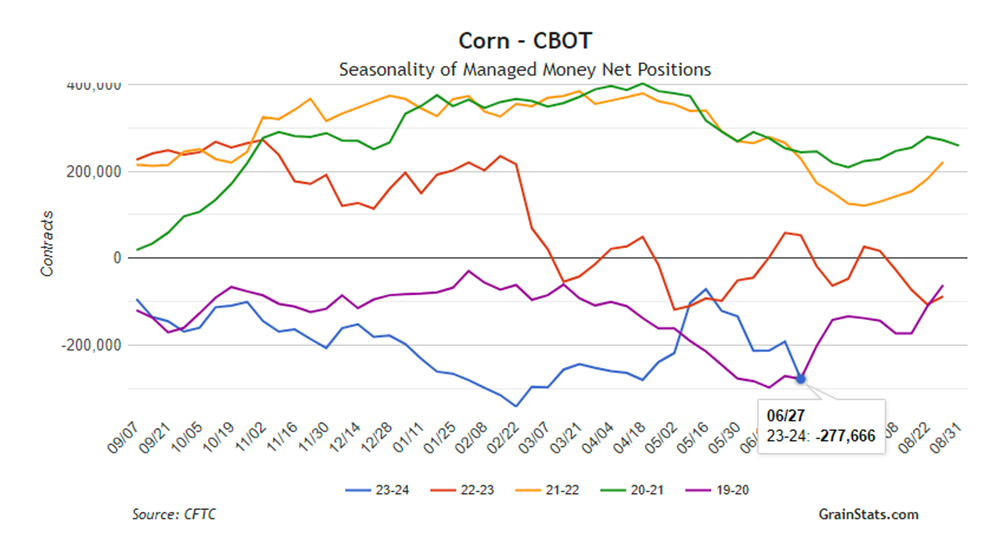

Commitment of Traders Report showed that funds added 86k contracts to their net short position ahead of last Friday’s report, taking them north of 277k contracts short.

US corn shipments declined last week. USDA reported 819,577mt (32mil bushels) of corn were inspected for export during the week ending June 27. That was down 29% from the previous week but up 21% compared to the same week last year. Soybean shipments declined vs. the prior week at 303,023mt (11mil bushels). That was down 13% compared to the prior week but up 15% vs. the same week last year. Wheat shipments declined compared to the previous week at 309,775mt (11mil bushels). That was down 10% from the previous week and down 9% vs. the same week last year.

Basis:

Basis is fighting the good fight and doing the hard work to keep old crop values alive in the western corn belt. Values in the eastern corn belt are weak, with corn basis in Ohio being steady to 5c worse in the last week. Selling in Illinois and Indiana have shut off for the time being with the farmer opting to wait 30 days for price improvement vs “give up” and sell now. Iowa has strong basis at the moment with values of 20-40 over. Nebraska basis is in the same boat as Iowa with relatively strong values. Plants trading 35-40-50 over with some corn being shuttled to Eastern CO and Western NE to fill shortages there.

Weather:

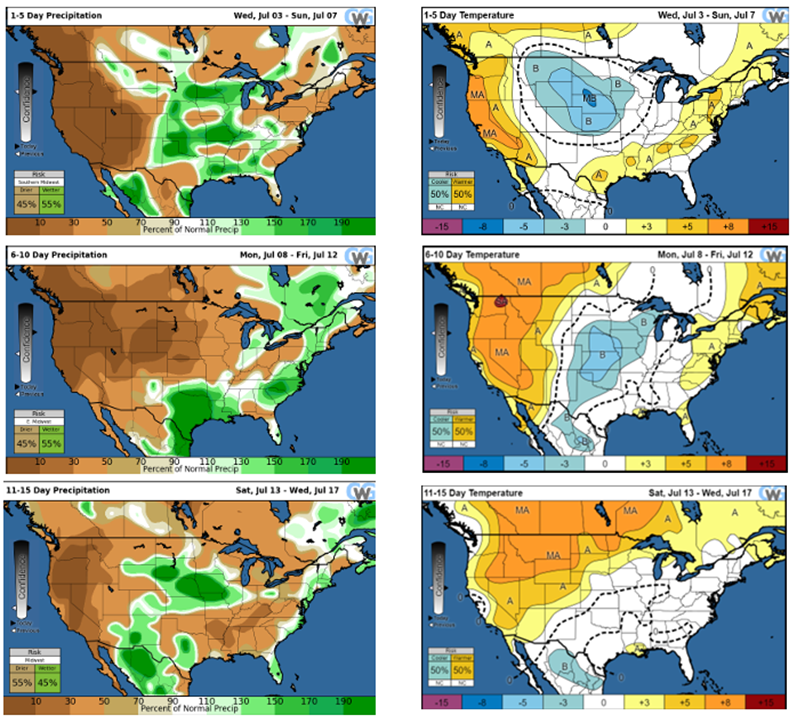

10-day forecast offers mostly widespread rainfall across the corn belt, although some pockets of the eastern corn belt may be left dry. Temperatures are likely to run below normal in the west and slightly above normal in the east over the next 5 days

Economy:

Rent prices are 26% higher than they were in 2020 and rising in three out of every five markets, per CNBC. Half of all renter households — more than 22 million — spent more than 30% of their income on housing.

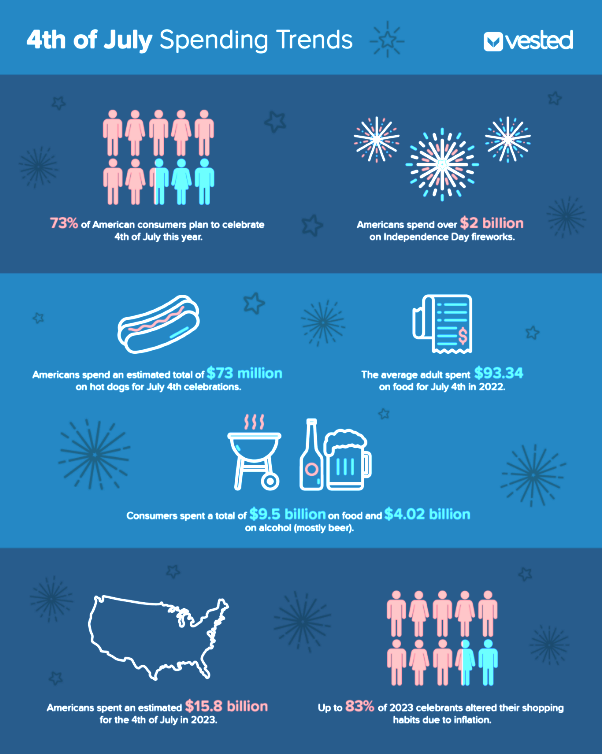

As Americans prepare to celebrate the 4th of July, expect higher costs for cookouts. This year’s American Farm burau market basket survey indicates a cookout for 10 people will cost $71.22, a 5% increase from last year and 30% higher than five years ago.

Something That Probably Means Nothing:

The grandest day for hot dog eating is July 4, when Americans wolf down 150 million hot dogs. According to the Council, that's enough hot dogs to stretch from Washington D.C. to Los Angeles five times

Quote of the Week:

"I like to see a man proud of the place in which he lives. I like to see a man live so that his place will be proud of him." – Abraham Lincoln