8.16.24 Tredas Weekly Recap

Weekly Action:

KC Wheat Sep24 down 14c at $5.40

Corn Sep24 down 6.5c at $3.705

Beans Sep24 down 50c at $9.39

Hogs Oct24 up 1.10 at $75.075

Fats Oct24 down 2.85 at $178.30

Feeders Sep24 down 0.275 at $239.50

Corn Dec24 down 3c at $3.92

Beans Nov24 down 45c at $9.57

Market Recap:

The August WASDE recapped below: (see additional graphs/charts from blog post earlier in week)

CORN:

All eyes were on new crop acres and yield; but to get old crop corn adjustments out of the way: we saw a slight 10 mil bu decrease in ending stocks from last month taking this crop year’s stocks to use to 12.6%. New crop harvested acres were projected at 82,710k; lowered from last estimates. This is now a nearly 4 mil acres drop from last year on corn. MN saw the biggest decline at 530k and would note IL 400k loss. KS did increase their acres by 650k. Yield was the most notable negative sentiment as we saw a big increase to 183.1 from 181 last report and 177.3 last year. This makes total production slightly above last estimate. However, we saw a drop in overall ending stocks from a nice increase in demand from exports at 75 mil as the US is positioned now to be the low-cost supplier. This is supported in that it noted the US holds a record large near 90% of the total world exporter stocks.

Market Reaction:

The market saw this report as neutral to slightly bullish as we rallied Monday from the 3.95 low Friday to 4.03 before settling back out at 4.015 on the CZ24 board. Many were hoping this would signal support and for 3 subsequent trading days we stayed around the $4 mark. However, today we have some liquidation pressure and are challenging the contract low at $3.90 as traders wait out a hopeful demand signal to spur the market.

BEANS:

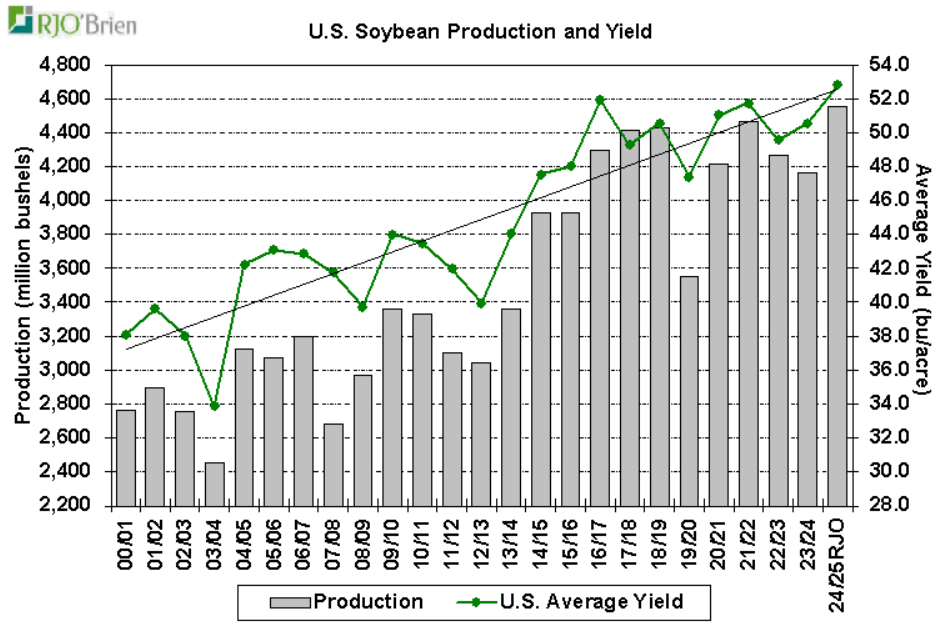

There wasn’t much friendly about the bean numbers produced. All eyes on new crop; Yield was increased to 53.2 from 52 bu/acre on last report. Harvested Acres reported at 86.271 from 85.261. This made the overall production at 4,589 up from the 4,435 mil bu # produced last month. This put the Ending stocks at 560 mil bu up from 435 last month and well outside the range of estimates from the trade. This did include a very modest 25 mil bu increase in exports.

Market Reaction:

Sharpy lower; again. We’ve moved another 50 cents lower from last week off this data and set a contract low for SX24 at 9.55. We now have entered an area last seen in August of 2020; on the positive side that time period did have some decent Chinese demand.

WHEAT:

USDA lowered the 24/25 acreage estimate by 975k acres but did slightly increase the yield from 5.18 to 52.2. Overall this dropped their production by 26 million bushels, thus lowering ending stocks to 828 mil bu. This put stocks to use ratios at 42.2% highest since 2020, but lower than last estimates. Likely not enough to change too much.

Market Reaction:

Despite a reduction in acres many still saw this as neutral to slightly bearish. Mainly due to the idea we are still up 18% on stocks from last year. We are currently down roughly 12 cents from Friday’s closes on the KC HRW contract.

COTTON:

USDA called acreage and production lower for the 24/25 production year. The 1 mil acre decrease in projected harvested acres were a surprise half in part to the reduction in planted acres. Couple this with a slight decrease in yield and we are projected to see a near 2 mil 480# reduction in production. Total ending stocks were at 4.5 mil 480# bales. This is a 800k reduction.

Market Reaction:

This surprise decrease in production spiked the cotton market to just under $0.71/ lb. However, traders were not too supportive of the data and ended up trading lower through the week and closed today around $.67/lb. Ending stocks are back to levels seen roughly 2 years ago.

Weather:

Short term: Eastern Corn belt looks to be wet and cooler in much needed areas of Indiana and Ohio that will help with dry soil conditions and bean size fill in pods. Western Corn belt will see moderate moisture in the upper plains, but overall temps starting to climb that will transition to warmer and potential record temps in the South to Southwest US.

Long Term: Eastern Corn belt will turn drier and look at potential of Tropical Storms moving in the Southeast US to bring cooler temps; otherwise, will stay average to below average overall on temps in the Eastern side of the US. Western corn belt as alluded will be warmer and drier. Prime for US corn harvest to progress in the south and moving north into Missouri etc.

End of August Temps:

Economy:

The Japanese market selloff that bled over to US markets early last week seems to be short lived as many see a difference in economic sentiment between the two countries and certain investors were able to cover positions they had against the Japanese Yen. Japan signaled they were raising interest rates from their historic 0% or sub 0% for only the 2nd time in 17 years that was inflating their economy. Many had a bet the Yen would fall in value to the US with potential rate increases state side; so, when the yen rose due to a rise in Japanese interest rates some were caught off guard. This subsequently scared global investors fearing the same would happen in the US signaling a potential deeper recession than thought and make the Fed pause on any interest rate cuts. Thus, hitting the US S&P and Stocks overall….especially in tech markets as it could hurt Japanese exporters profits from a stronger yen. This hurt Intel and others who are also cutting costs by laying off 15% of its workforce much like John Deere etc.

How does this affect Producers?

It’s no secret – the ag sector is in a recession fueled by lower prices due to recent higher supplies in grains/oilseeds and projected for cotton. Couple that with the inflated equipment prices many paid and now seeing belt tightening with no new equipment purchases, driving deeper hits to the likes of John Deere’s P&L. These moves are signals of what could loom ahead to producers bottom lines. John Deere has subsequently (to many of our community’s detriment) cut costs and softened some of the red ink on their balance sheet. Where will producers make their cuts?

Many were hoping this would be a signal to investors to find other spots for their money. I.E. ag commodities to fuel a price rally and reverse the funds short positions. This didn’t happen…or at least quite yet. We are looking to find demand from the fringes as we wait for the big players like China to come in for the cheapest priced beans and corn in the market right now. (hint…recently the US).

Something That Probably Means Nothing:

Gold jumped again recently and made fresh highs as it returned to highs made in mid-July and mid-May at 2,538.7 today. This is possibly where investors are harboring their money as housing news comes in disappointing and the dollar slid. This recession news helps the camp to drop interest rates come September.

Quote of the Week:

“Be curious, not judgmental.” - Walt Whitman and the great Ted Lasso.

Enjoy your weekend and the beginning of school!