11.1.24 Tredas Weekly Recap

Weekly Action:

Corn Dec24 unchanged at $4.15

Beans Jan24 unchanged at $9.95

KC Wheat Dec24 down 16c $5.66

Hogs Dec24 up 4.325 at $84.000

Fats Dec24 down 3.150 at $186.000

Feeders Nov24 down 1.475 at $247.000

Corn Dec25 unchanged at 4.41

Beans Nov25 down 1c at $10.33

KC Wheat July25 down 28c at $5.99

Market Recap:

October provided us our fall crop insurance prices of Corn: $4.16 (spring price: $4.66), Soybeans: $10.03 (spring price: $11.55), and Sorghum $4.17 (spring price: $4.66).

Corn:

Corn futures traded either side of $4.14 to end the month of October, with many moving averages causing congestion at that price level. Technicals of the Dec24 contract, are currently in no man’s land - RSI, MACD, Stochastics all being middle of the road.

Flash sale this morning of corn to Mexico - 781,322 MT (30.7 mil bu), with 715,800 MT (28.1 mil bu) for 2024/25 shipment and 65,532 MT (2.5 mil bu) for 2025/26. Export Sales show total export commitments for corn at 25.82 MMT (1 bil bu), a 3-year high for the current week and up 41% from last year. That is also 44% of the USDA export forecast (which is 4% faster than the averages sales pace).

StoneX estimates the Brazilian 2024/25 corn crop at 128.53 MMT (5 bil bu), with the first crop at 24.88 MMT and the second crop at 101.5 MMT.

Soybeans:

Soybeans were off to an early start spending the early hours of AM trading up 8-10c, but ultimately faltered into the finish line. With November First Notice Day (Oct 31st), many were forced to price or roll basis contracts in town, which historically speaking in “larger” crop years, first notice day is associated with price weakness in both futures and spreads. While both were soft this week, there was no collapse or major failure into Thursday.

USDA reported private export sales of 198,000 MT (7.2 mil bu) of soybeans to unknown destinations and 132,000 MT (4.8 mil bu) of soybeans to China for 2024/25 delivery this morning. Another 30,000 MT of bean oil was reported as sold to India.

The recent uptick in export sales has taken soybean commitments (shipped and unshipped) to 26.266 MMT (965 mil bu) , up 13% from last year. That is also 52% of the USDA export projection.

Weather:

USDA released weekly drought monitor data Thursday with some areas of the corn belt received rainfall over the previous two weeks, but the moisture offered no measurable improvement. Roughly 75% of the corn belt is experiencing some level of drought (up from 66% last week). US Areas Experiencing Drought:

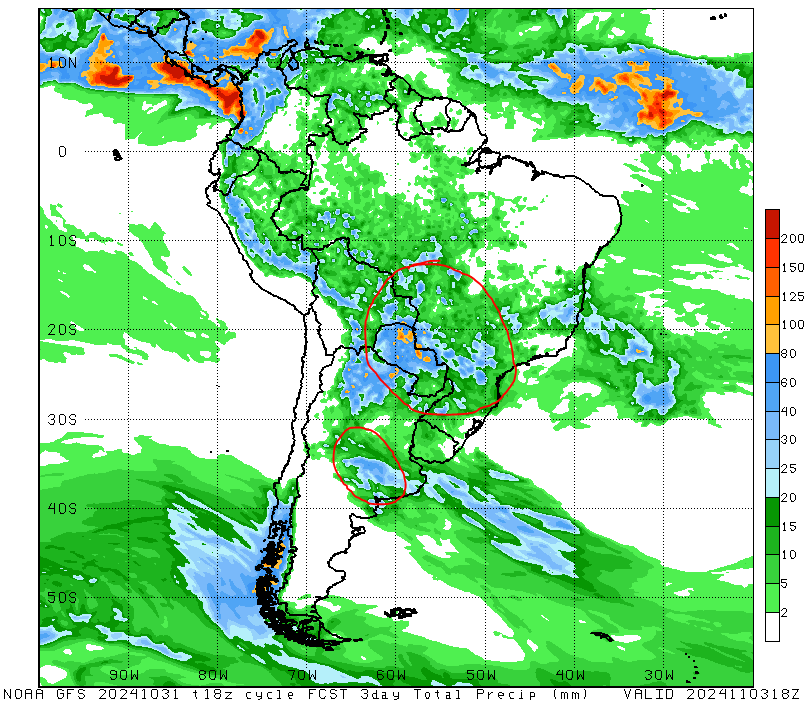

Midday GFS is slightly wetter in Mato Grosso, but the overall pattern remains the same – widespread rainfall. Soaking totals impact Buenos Aires in Argentina over the next 72 hours, while routine daily shower chances persist across Brazil into mid-month.

Economy:

Job creation in October slowed to its weakest pace since late 2020 as the impacts of Hurricane’s Helen and Milton are still being felt across the southeast.

Nonfarm payrolls increased by 12,000 for the month, down sharply from September and below the Dow Jones estimate of 100,000. In what had already been expected to be a downbeat report, October posted the smallest gain since December 2020.

However, the unemployment rate held at 4.1%, which was in line with expectations. A broader measure of unemployment that includes discouraged workers and those holding part-time jobs for economic reasons also was unchanged at 7.7%.

The last inflation report ahead of Tuesday’s election and next week’s Federal Reserve Meeting shows prices rose at a 2.1% annual rate in September – a hair away from the central bank’s 2% target.

The personal consumption price expenditures index report on Thursday showed inflation at the lowest level since February 2021 and down from 2.2% in August. The core index, leaving out energy and food costs, was 2.7%. Neither is likely to change the Fed’s thinking when it gathers to consider monetary policy Nov. 6 to 7. Analysts believe the Fed will lower interest rates by 25 basis points following its surprise half-percent cut in September.

Something that probably means nothing:

During World War I, the term “No Man’s Land” was used to describe the area between the front lines of opposing armies. The area was narrow, muddy, treeless, and covered with barbed wire and shell holes.

Quote of the Week:

“Victory is not always about winning; sometimes, it’s about learning from the journey.”

Thanks and have a great weekend!