11.8.24 Tredas Weekly Recap

Weekly Action:

Corn Dec24 up 16 at $4.31

Beans Jan24 up 36 at $10.31

KC Wheat Dec24 down 2 $5.64

Hogs Dec24 down 3.40 at $80.60

Fats Dec24 down 2.30 at $183.70

Feeders Jan25 down 1.175 at $241.425

Corn Dec25 up 8 at 4.49

Beans Nov25 up 19 at $10.52

KC Wheat July25 down 4 at $5.95

*Monday is Veteran’s Day. Banks are closed but markets will be open.

Although World War I wasn’t officially over until the Treaty of Versailles was signed in June 1919, fighting stopped on the 11th hour of the 11th day of the 11th month. In 1919, America celebrated the first anniversary of Armistice Day. In May of 1938, Congress made Armistice Day a Federal holiday. Following war efforts in World War II and Korea, Congress changed the name of the holiday to Veterans Day to properly honor American Veterans of all wars.

November WASDE:

Initial market reaction is supportive corn and soybeans.

Corn:

Corn yield was cut by 0.6 bu to 183.1 bpa and production was lowered 60 million bushels to 15.143 billion.

Corn ending stocks dropped a similar amount as 24/25 demand was left unchanged. Some traders expect ending stocks to continue tightening as export demand remains brisk. It would not take large increases in exports and ethanol demand to get ending stocks below 1.9 billion bushels. If realized, this would only be 100-150 million bushels higher than last year despite record yield.

Illinois and Nebraska yields was reduced 4 bpa while Texas dropped 9 bpa.

Colorado, Oklahoma, and Texas lost nearly 28 million bushels of production. Iowa and Nebraska are nearly 32 million bushels lower.

This represents over 130 shuttle trains of lower production than last month. Keep an eye on basis moving forward.

World stocks were lowered 2.4 MMT (96 million bu) which is mostly attributable to lower US production. Mexican imports were raised 1.5 MMT to 24 MMT (960 mln bu) which would be a record. However, Chinese imports were lowered 3 MMT.

Soybeans:

Soybean yield was cut by 1.4 bu to 51.7 bpa and production was lowered 121 million bushels to 4.461 billion.

Soybean ending stocks dropped 80 million from last month to 470 million bushels.

Yield decreased by 2 bpa in Illinois and Minnesota, 4 bpa in Missouri, and 3 bpa in Iowa.

World stocks were lowered 3 MMT (111 mln bu) in large part due to lower US production.

Wheat:

US wheat ending stocks were raised 3 million bushels.

World stocks changed just a few million bushels.

Weather:

Argentina’s ag belt has seen plentiful rain the past few weeks. Brazil still has potential for record production as the 10-day accumulation in their key growing areas has been more than adequate. The two-week outlook shows near-normal rainfall.

The NOAA 7-day forecast features good rains in the West and Southwest areas of the corn belt. This should be extremely helpful for HRW establishment.

Economy:

Below is analysis from RJO’s Tom Pawlicki discussing the S&P 500 trends after presidential elections:

The S&P 500 has moved higher between October 31 and December 31 in 15 of the 19 election years since 1948. It may be due to a sense of optimism or possibly part of a normal year-end pattern that takes place as books are closed and the holidays approach.

A closer look at the data shows that some of the initial post-election trends remain in place a week or several weeks later. That could signal that a moderate upside follow-through from today’s rally is possible in coming weeks. Today’s trade moved nearly 2.5% higher from yesterday’s election day close. In the 11 election years since 1980, there have been similar-sized gains such as in 1980, 1996 and 2020, and the market traded at the same level or higher five days later as well as by the end of November and December. S&Ps traded lower in 2000, 2008 and 2012 and the market expanded on those losses in the weeks that followed in a similar way. Only two years did not maintain their initial post-election trend, which were 1988 and 1992. The market initially sold off in both years but ended each year higher compared to election day.

The S&P is up nearly 5% for this week.

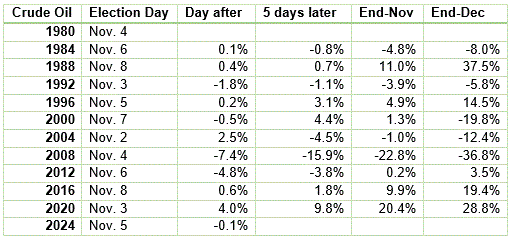

The oil market appears somewhat similar, in that the directional change on the day after election day was held or expanded in the weeks that followed in 6 out of 10 years. The data is much more volatile than the S&P 500 trends, so its usefulness in projecting where the market will be in the next several weeks is diminished. One year that might stick out is Trump’s first administration in 2016, as oil prices moved sharply higher through the end of the year. WTI traded at $45/bbl on election day that year, but ended the year close to $54/bbl.

Something that probably means nothing:

Legendary announcer Pat Summerall’s daughter is Susie Wiles. She was named Donald Trump’s White House Chief of Staff.

Quote of the Week:

“Winning or losing of the election is less important than strengthening the country.” – Ghandi

Have a great weekend!