Tredas Recap 7.19.24

Weekly Action:

Corn Sep24 down 12 at $3.92

Beans Sep24 down 23 at $10.36

Fats Aug24 down .35 at $182.90

Feeders Aug24 down 3.35 at $255.40

Corn Dec24 down 11 at $4.06

Beans Nov24 down 29 at $10.35

Market Recap:

Lower trade Monday gave way to flat trade for balance of the week as funds remain record short corn and weather threats lack as demand rises on low prices.

Corn:

Funds hold their record short position as National weather remains ideal heading into pollination. Eastern Nebraska and Western Iowa are expected to catch the abundance of moisture over the weekend adding to already saturated soil.

Ethanol report Wednesday was bullish and provided short term support. Average daily production is a record for this time of year. Low corn prices and strong demand are a perfect storm for the industry.

Corn exports have also been on pace with USDA expectations and currently sit at 96.8% of forecast vs the 5 year average of 96.2%.

Reaction: December corn tested the low by a quarter of a cent this week and closed near the 9 day moving average of 4.09. The 9 dma will be the nearest form of resistance, so any close above will be positive.

Soybeans:

Flash sales Thursday morning of 510,000 and Friday of 110,000 metric tons as

Soybeans remain the easy sell for fund managers as corn is already at a record short and July weather shows zero threats to the soybean crop. Demand has ramped up as Gulf basis rises to offset lower futures value. Exports are currently behind the USDA projection, but rumors swirl that China will be looking to secure fall delivery US soybeans prior to the election.

In 2023, China began a buying spree of US soybeans from August to October. November 2024 soybeans are sitting at $10.40 vs 2023 at $14.00 in August 2023.

Reaction:

November futures made a new contract low of 10.32 ahead of Wednesdays export sales. Futures had a narrow range this week outside of Monday’s collapse.

Weather:

Weather threats non-existent as cooler than average temps are on tap the next 7 days, the better part of the Ag belt will be dry aside from central to eastern Nebraska having good chances over the weekend. As we go into the back half of the month temps heat back up running 3-5 degrees above normal. However precipitation is leaning normal to slightly above normal in the I-states. Below graphics are from BAM weather.

Economy:

Saturday quickly became one of those moments in history where most will remember exactly where they were and what they were doing the moment Trump was half an inch from being assassinated.

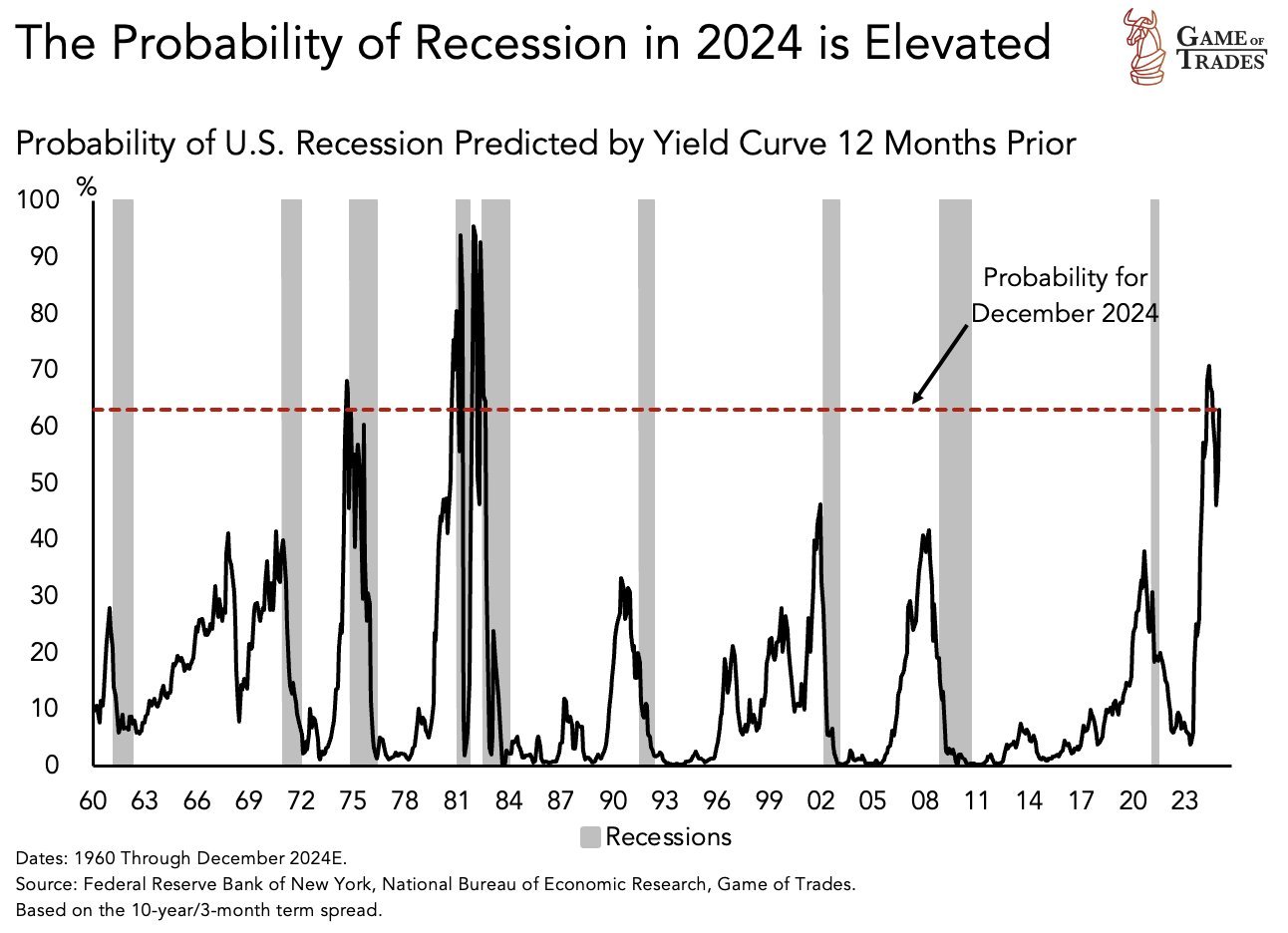

Something That Probably Means Nothing:

The probability of a recession by Dec 2024 is at 63% This level has ONLY been seen 3 times since 1960: - 1974 - 1980 - 1981 All 3 ended in severe recessions. This might mean something actually.

Quote of the Week:

“The best way to show my gratitude is to accept everything, even my problems, with joy.” – Mother Teresa

Enjoy your weekend!